Sentiment was cautious in H1 2025 as trade/tariff headlines and macro uncertainty weighed on leasing conversion (with decision drag more pronounced in big-box and lower-grade stock). Even so, a thinner development pipeline and firm prime rents point to clear leasing upside, especially in core locations, as visibility improves and confidence returns.

What’s slowing decisions – Sentiment over fundamentals

In European logistics, the direct tariff hit looks limited; confidence is the swing factor. With roughly two-thirds of occupier demand tied to retail, softer consumer and business sentiment slows conversions even when the operational case is strong.

Developers and owners report clients returning to discuss strategic investments, with conversations focused more on economic recovery than on tariffs. Many portfolios are geared to inward European consumption, which is less tariff‑sensitive; uncertainty still protracts decisions, but it isn’t derailing plans.

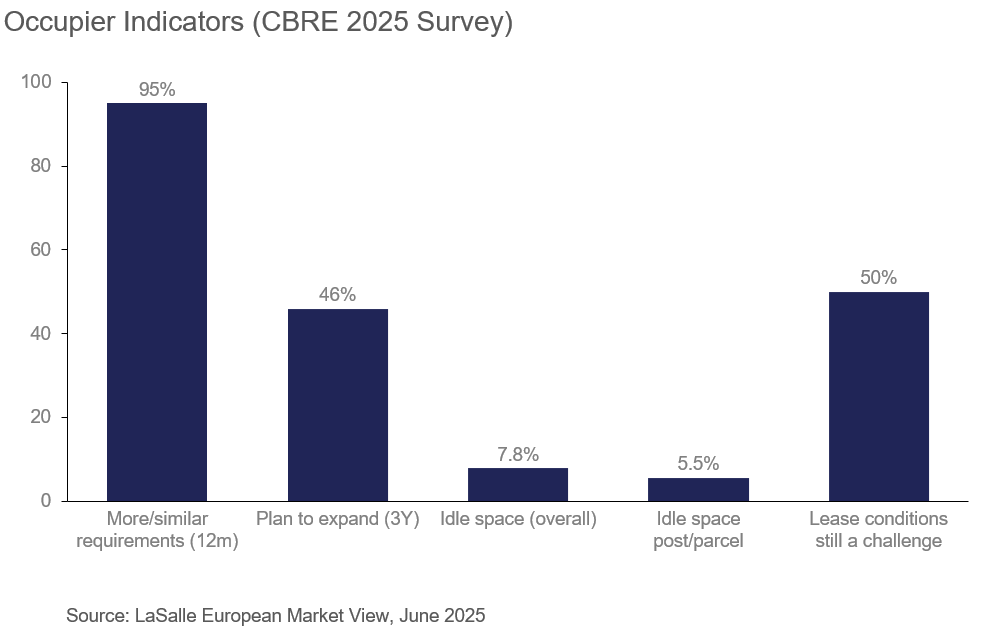

Medium-term demand drivers remain intact with 95% of occupiers surveyed by CBRE intending to launch more or similar requirements over the next 12 months, and 46% plan to expand footprints over three years – despite near-term uncertainty. Enquiries and viewings reportedly picked up in Q2, but this has yet to show in take-up; Focus shifts to Q3 to crystallize interest.

A recalibration period – Structural drivers intact

Across Europe, tenants are taking longer, seeking flexibility, and deferring capex, but demand for well-located, modern space remains firm. For prime assets, landlords still hold pricing power as obsolescence drives a flight to quality, deepening the two-tier market.

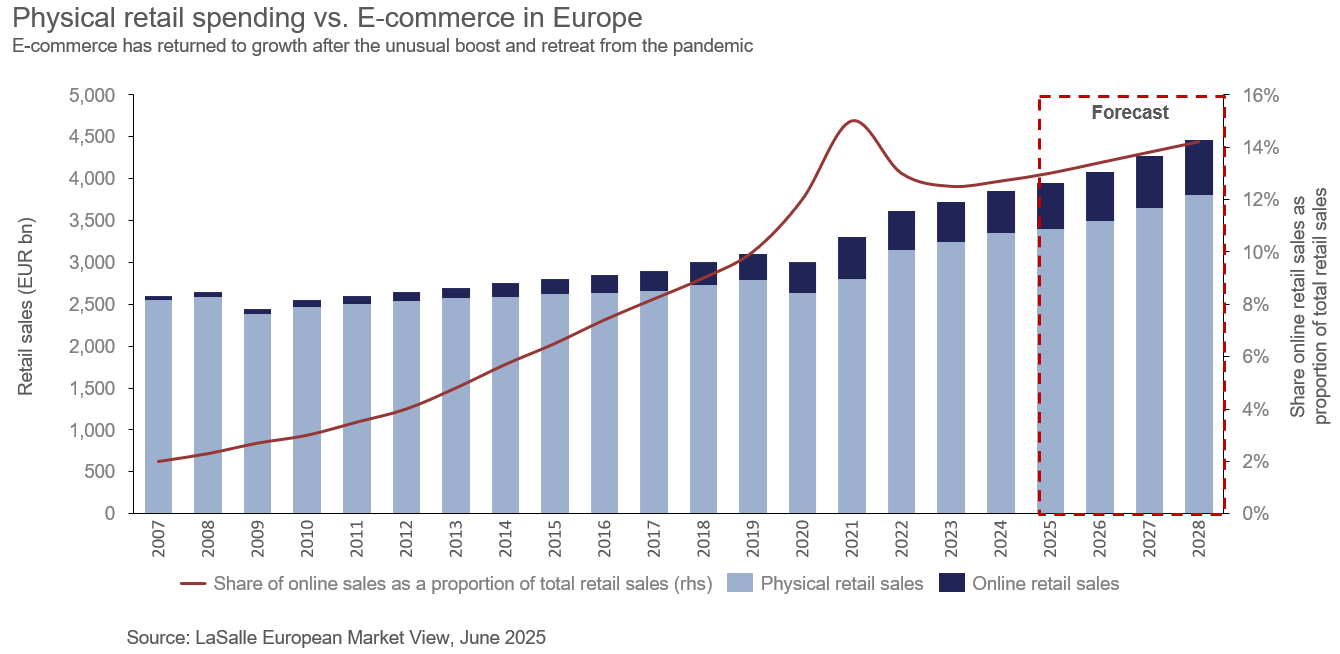

Longer-term demand continues to be anchored by structural drivers: continuing e-commerce growth, which lifts service expectations and expands needs for urban fulfilment, returns and parcel hubs; omnichannel and supply-chain optimization, with retailers/brands shifting inventory closer to customers to cut transport and failed-delivery costs while boosting availability and conversion, making proximity to dense consumer and labor pools more valuable; and a knock-on uplift from nearshoring and defense, as light manufacturing and suppliers move nearer to end-markets and rearmament adds storage, MRO and parts-distribution needs.

Together, these forces reinforce demand for modern, urban-adjacent, high-throughput space and keep the medium-term outlook intact despite short-term sentiment noise.

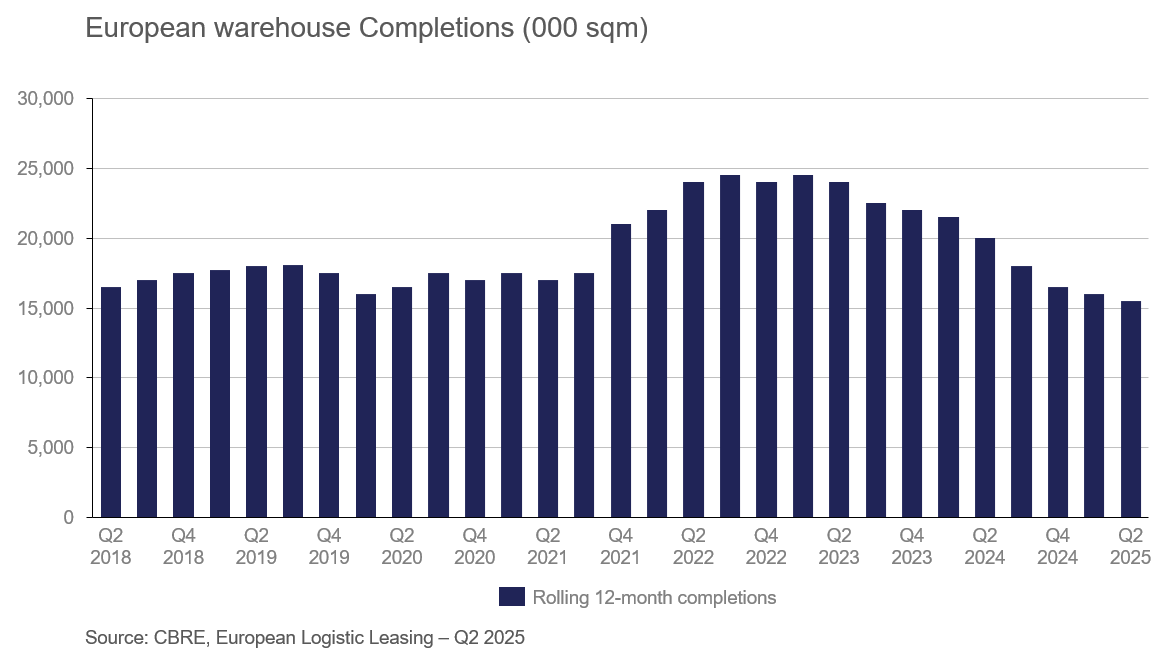

Supply is doing the quiet work. Logistics space completions have fallen back to 2017 levels (35% drop between 2022 and 2025) with speculative developments down to around 40%. Analysts expect vacancy to trend down through year‑end as the pipeline tightens. That’s consistent with a market in recalibration, not retreat. Prime rents are broadly stable; CBRE’s index shows c.3.1% annualised prime rental growth in Q2 2025 despite a slightly disappointing take-up and vacancy rates.

A V‑shaped snap‑back is on the cards

A V-shaped acceleration in take-up is plausible once visibility improves, as flagged by Savills (UK post-Brexit take-up snap-back used as analogue), with today’s tariff-related uncertainty creating a similar pause-then-pounce dynamic.

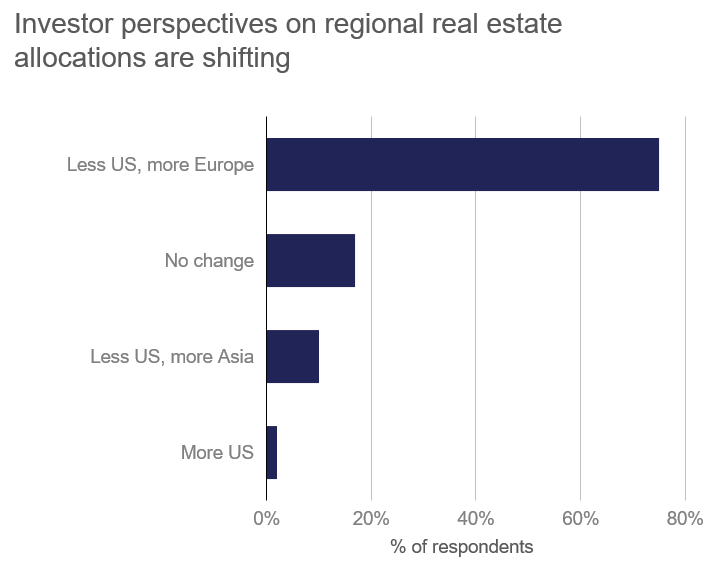

Capital flows are returning – broadening, but concentrating in core nodes

European industrial & logistics investment rose 4% YoY in H1 2025 to €17.4bn (Q2 +7% YoY to €8.8bn), keeping the sector at ~18% of CRE. Over the last 12 months, capital reached ~€41.6bn, with ~68% sourced within Europe; cross-border +16% and North American inflows +38% underline widening international appetite.

Within our focus markets, Italy was among the standouts (+72% YoY in H1), Germany tallied ~€2.6bn in H1 (–14% YoY), France ~€0.7bn (+1% YoY), and Benelux was –25% YoY in H1 but improved into Q2.

Post recalibration and with supply tightening, rents steady, capital refocusing on core, and enquiry pipelines set to convert, the sector is positioned for acceleration, potentially V-shaped, as visibility improves and economic growth picks up.

By the numbers (Q2 2025)

- Take‑up: c.20.6m sqm on a rolling 12‑month basis (−3.8% in Q2), still c.9% above the pre‑pandemic average.

- Vacancy: c.5.4% on average across Europe

- Completions: back to 2017 levels; down to c.40% speculative.

- Rents: Prime rents broadly stable; CBRE’s index ~3.1% annualised in Q2 2025.

What to watch next (turn signals)

- Conversions: Q3/Q4 take-up from conversion of the Q2 enquiry pipeline.

- Vacancy & supply: q/q vacancy change versus completions and net absorption.

- Pricing: prime yields in core markets.

Sources

CBRE – European Logistics Leasing Figures | Q2 2025.

CBRE – European Logistics Occupier Survey 2025 (July 2025)

CBRE – European Industrial & Logistics Capital Market Figures | Q2 2025

Savills – Deep dive into EMEA Industrial & Logistics (Call)

JLL – Italy Industrial & Logistics | Q2 2025.

WDP – 1H25 Conference Call