Macro Landscape and Policy Backdrop

As of Q2 2025, the European macro environment is marked by cautious optimism tempered by persistent policy and geopolitical uncertainty. Rising trade tensions have reintroduced volatility and clouded the global growth outlook.

While the base case assumes moderate tariffs with a limited impact on GDP, the risk of a downside scenario – characterized by slower growth, higher inflation, and sustained uncertainty – is increasing. Such conditions could weigh on cyclical sectors, including industrial real estate, which is sensitive to fluctuations in global trade and manufacturing output.

However, monetary and fiscal support is helping cushion the economy. The ECB has cut its deposit rate for the seventh time to 2.25% in April 2025, in the absence of any immediate sign of resurging inflation, with further reductions anticipated by year-end. Meanwhile, fiscal policy across the eurozone has turned more expansionary – exemplified by Germany’s suspension of its constitutional debt brake to fund infrastructure and defense initiatives. These combined measures, along with resilient labor markets and modest real wage growth, could help stabilize domestic demand across the region.

In this context, logistics real estate – particularly in markets driven by domestic consumption -continues to show resilience, supported by its own structural fundamentals—tight urban supply, ESG-driven demand, and e-commerce tailwinds. Reflecting this, listed European industrial REITs – often a leading indicator – have largely rebounded from earlier corrections, underscoring investor confidence in the sector’s long-term fundamentals.

Finally, under this scenario, a weakening of the U.S. dollar’s global reserve status could accelerate capital reallocation toward euro-denominated assets, potentially benefiting European real estate markets further.

Western European Logistics Real Estate: Q1 2025 Snapshot

The logistics property sector across Western Europe exhibited signs of stabilization in Q1 2025. While occupier take-up remains below long-term averages, leasing activity rebounded slightly from 2024 lows. Take-up across Europe rose 2% YoY, although still 21% below the 10-year average. Vacancy rates stabilized around 5%, reflecting both weak completions and resilient demand for grade A stock.

Spain led growth, with take-up exceeding its 10-year average by 50%. Italy and France showed strength in core nodes such as Milan and Paris, while Germany recorded modest but improving absorption rates. The Netherlands saw subdued activity driven by cautious occupier sentiment. However, the limited new supply in the Netherlands sustains rental growth, especially for prime, well-located modern assets.

Structural Trends & Investment Landscape

Supply and Demand

In response to the surge in Covid-related demand during 2021–2022, developers increased supply, although demand has declined since, resulting in vacancy rates rising from a record low of c.2.5% on average in 2022 to over 5%.

On the supply side, development remains subdued, with completions forecast to drop 32%. As of late 2024, only 4.3% of total logistics stock was under construction – well below the five-year average of 6.7% (Barclays) – as reduced profitability has made development less attractive. Notably, European REITs such as WDP and Montea have indicated shifting focus to acquisitions, securing portfolios at ~6% yields, with development returns having halved (with YoC in a 6% to 8% range) and carrying greater risk.

Looking ahead, new supply and demand are expected to be more balanced. However, if demand rebounds faster than anticipated in 2026–27, the limited development pipeline could lead to a pronounced supply squeeze.

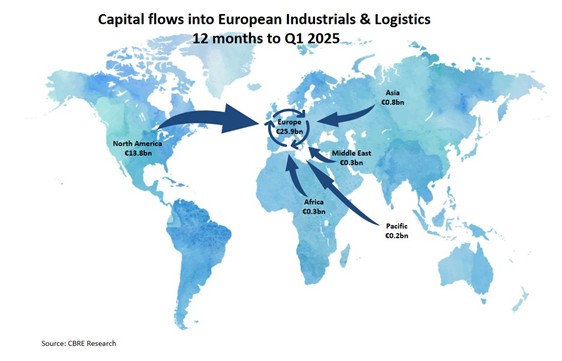

Capital Flows and Performance

Modest yield compression is returning across markets, suggesting growing investor confidence, driven primarily by stabilizing interest rates and pricing now in ‘fair’ territory. The trough in European real estate capital values seems to have passed, and investor sentiment is gradually recovering with urban logistics, now the second most sought-after property sector after residential, driven by its defensive cash flow profile and structural tailwinds. Capital rotation into logistics is evident: France recorded €3.4bn in logistics investment in Q1 2025 (+67% YoY), while Italy saw over €600m in logistics transactions, part of a broader €2.7bn total (CBRE). These flows suggest growing institutional appetite for inflation-protected logistics assets in core urban areas.

Urban logistics continues to outperform the broader sector, underpinned by e-commerce growth, domestic consumption, and the need for proximity to end-users. Demand is presently strongest for modern, ESG-compliant, and automation-ready facilities, especially in dense urban corridors. Obsolete or non-compliant stock faces rising vacancy risk unless upgraded or repositioned, as tenants prioritize operational efficiency, sustainability, and future-proof specifications.

From a pricing perspective, prime stabilized yields in Western Europe currently range between 4.25% and 5.25%. CBRE data shows that valuations improved further in Q1, with prime yields compressing 20bps in Spain, 25bps in Belgium, and 10bps in Italy – indicating renewed investor confidence and pricing resilience. Colliers also notes a pickup in investment led by capital targeting defense-related and nearshoring logistics facilities, particularly in CEE markets such as Poland and Romania.

At the same time, Prime yield spreads versus local 10-year sovereign bonds remain attractive (c.260–320bps), particularly as inflation trends toward normalization around 2%. This supports continued institutional interest, especially from insurers and pension funds seeking duration-matched income with embedded inflation protection.

Investment Opportunities

In this context, the market continues to present value-add opportunities, with investors executing capex-driven strategies on existing assets able to underwrite post-capex gross initial yields (GIYs) above 8%. These typically involve short lease durations, ESG-led refurbishments, or the repositioning of underutilized urban logistics stock—offering compelling upside potential amid a lower interest rate environment.

Strategic Outlook: H2 2025 and Beyond

The second half of 2025 is expected to bring improved leasing and investment activity. ECB rate cuts and easing inflation should create a more favorable financing environment, enhancing transaction volumes.

Logistics yields are expected to compress selectively into 2026. AEW forecasts a 40bps compression over five years, a view broadly echoed by Savills, CBRE, and BNP Paribas Real Estate, who cite constrained supply, resilient occupier demand, and an improving rate environment. While JLL adopts a more measured stance, it concurs that yields have likely peaked and sees potential for modest tightening in core urban markets.

From an occupier perspective, tenant decision-making remains delayed, and pre-letting activity is still sluggish. That said, speculative development has declined sharply —JLL forecasts a 30% decline in completions across Europe in 2025—this should support rental growth in undersupplied nodes.

Medium-term prospects remain strong. Logistics rents are expected to continue outpacing inflation. Defensive and infrastructure-driven fiscal policies are expected to support logistics demand in Germany, Italy, and to a lesser extent, France (where procurement focus is more aerospace and technology-heavy).

Capex-heavy repositioning strategies should gain popularity as legacy assets seek to meet ESG and operational benchmarks. Brownfield regeneration is already accelerating across constrained urban markets, often integrating onsite renewable energy infrastructure to meet ESG goals.

Risks to the above include prolonged trade tensions, global monetary misalignment, and weaker consumer sentiment. Geopolitical uncertainty—including the risk of retaliatory EU tariffs—may weigh on export-led logistics demand, especially in Germany and the Netherlands. However, logistics’ defensive characteristics, especially in urban segments, provide an enduring buffer as investors will prioritize liquidity, location quality, and income resilience.

In Summary

European logistics real estate is emerging from a period of adjustment with core fundamentals intact and early signs of renewed momentum. While short-term sentiment has been shaped by macro headwinds – particularly trade policy uncertainty and uneven occupier demand – market conditions increasingly suggest a cyclical pause rather than a structural downturn.

Looking ahead, strategies focused on urban infill redevelopment, ESG-led repositioning, and tenant-driven upgrades are well positioned to outperform. For long-term investors, the sector continues to offer a compelling mix of stable income, inflation protection, and exposure to enduring structural themes—from e-commerce and automation to nearshoring and the energy transition.